The future is here.

It’s 2021 and it’s already time for businesses to ready themselves for the new decade. The previous year has shown us that you have to be prepared for both expected and unexpected disruption, emerging risks, and economic uncertainties. Your business models and operations, employees and technology have to be agile and resilient.

New business risks are everywhere. What challenges can organizations expect in the emerging and evolving risk landscape, and how can they overcome them?

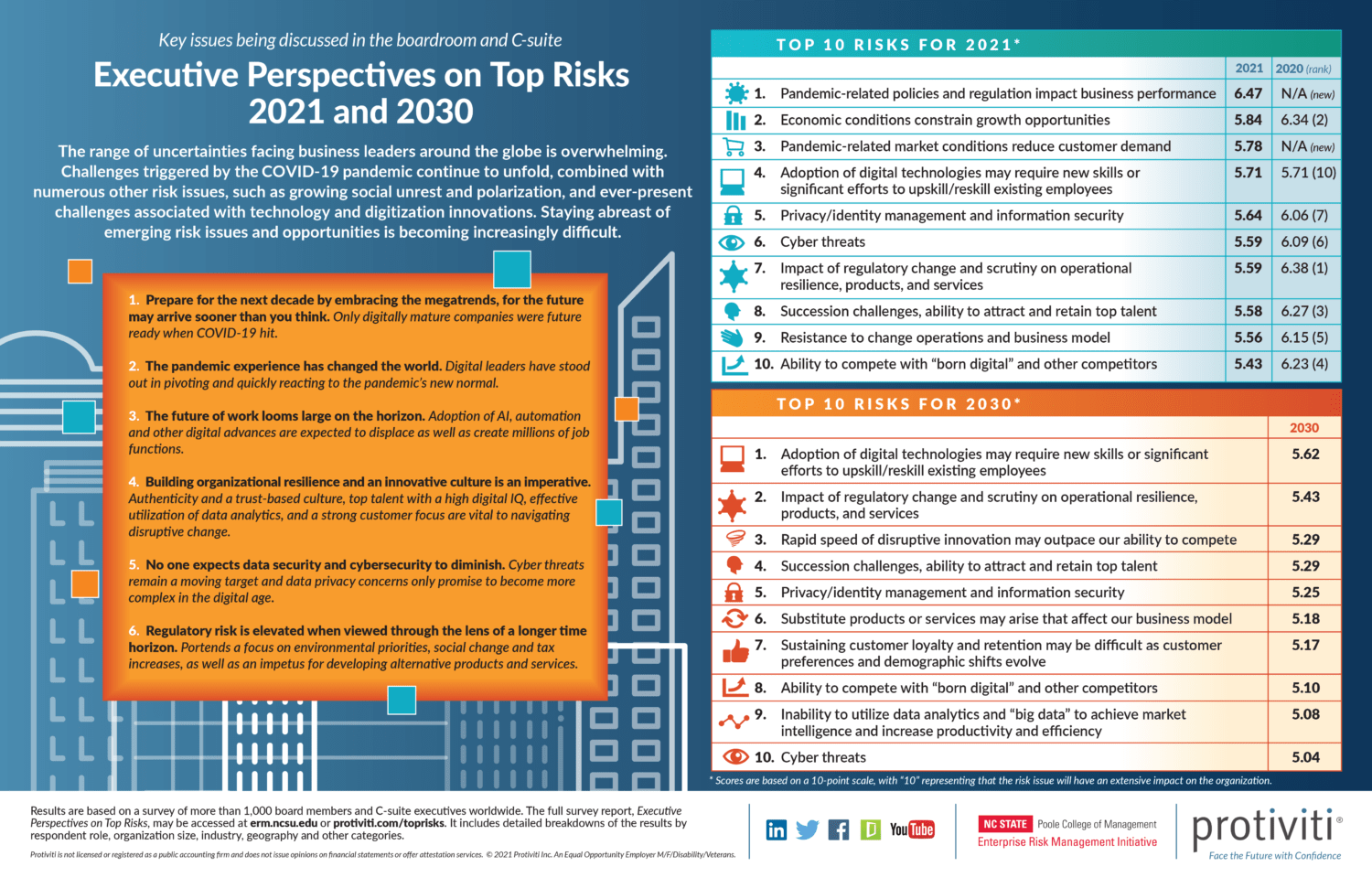

Ronald van Loon is working in partnership with Protiviti, and recently had the opportunity to examine their study, conducted jointly with North Carolina State University Poole College of Management’s Enterprise Risk Management (ERM) Initiative, on Executive Perspectives on Top Risks:2021 and 2030 and share his outlook regarding the shifting risk landscape and its impact on modern organizations.

Businesses need to take the lessons learned from the tumultuous events of 2020 and use them as an opportunity to thrive in 2021 and beyond. This requires a strategy that enables businesses to define potential risks, and then outline and implement strategies that are going to help overcome those risks in various scenarios.

A continuous cycle of anticipate, prepare, mitigate, enabled by the right digital and intelligent capabilities, can help organizations better respond and manage risks, predict future challenges, and quickly pivot alongside the pace of change.

Risks in 2021 and Beyond

Digitally enabled businesses were more prepared for the dynamic pandemic-induced challenges that arose in 2020. These companies were able to respond quickly, adapt to rapid changes, and set themselves up for future success.

Below are some of the foremost risks to expect according to top executives from the Protiviti-NC State report, which are broken down into three categories: macroeconomic risks, strategic risks, and operational risks.

Macroeconomic Risks

- Political & Governmental: The policies and interactions of global leaders or changing global trade policies stifle growth; concerns regarding recovery from pandemic, sustainability of government stimulus programs; impact of long-term debt governments are accruing.

- Talent: New technologies like artificial intelligence (AI) and automation change the job skills requirements of employees resulting in upskilling, reskilling or hiring challenges.

Strategic Risks

- Shifting Market Conditions: Customers transactions are increasingly shifting to online channels, impacting demand for products and services.

- Disruptive Technologies: Technologies like AI, machine learning (ML), and automation affect how organizations can compete.

- Keeping Customer Loyalty: Constantly evolving customer preferences and demographics might alter how customers interact with organizations.

- Changing expectations: Environmental or social expectations, such as with climate change, or the increasing need for inclusivity, are challenging to identify and react to.

Operational Risks

- Remote Work: Difficulty reacting to infrastructure or technological changes required to meet the needs of a remote or hybrid remote workforce.

- Cyber Threats: Being unprepared for potential damage to brand, reputation, or business disruption from security threats.

- Lack of Technology: Outdated operations, legacy systems, and failing to advance digital initiatives prevent an organization from being competitive.

- Data & Analytics: An inability to use data and analytics for strategic purpose and advantage.

Risk Perspective for 2030

Operational and strategic risks are the center focus of risks that executives are looking at moving into 2030. Business executives are concerned with the displacement of talent and skill requirements as a result of technology like AI, automation and natural language processing (NLP), that are being used to upskill, train or retain talent.

Also, business leaders are apprehensive about the rapid increase in disruptive technologies and their ability to quickly adapt their business models to meet this demand. Furthermore, data privacy and security are going to become even more complicated moving into 2030 as digital capabilities continue to advance, online transactions increase, and cybersecurity threats evolve.

So, what can businesses do about it?

Effectively Mitigate Current and Future Risks

Being sufficiently prepared for risk is critical, but trying to implement overly complicated risk management processes and strategies can be potentially more detrimental than helpful, especially during a crisis like that of the COVID-19 pandemic. Preparation of necessity entails strategic and digital thinking as both opportunities as well as threats underpin the above risks,

Business leaders are responsible for defining and delivering guidance to crisis management teams based on an agile approach. A business can better respond to risks because they have defined risk types and corresponding procedures for how they can effectively address them. They also have a strategic-level view of risks on the horizon that could affect the viability of their products, services and/or business model.

This involves discussing what those risks are, their impacts, what will happen, and how prepared your organization is for those risks.

It’s important to embrace real-time response capabilities that enable faster decision-making and responsiveness to risk in order to prevent negative impacts to the organization. A preemptive approach to risk enables businesses to manage potential impacts before they further escalate.

This should be a company-wide effort among business leaders. Executives should help to define potential risk scenarios and create a team that’s responsible for implementing strategies should any risks occur, including identifying and deploying specific people who are responsible for addressing certain risks.

An agile, robust business strategy supported by focused risk management not only helps organizations mitigate risks, but it also positions them for future growth and success, encourages them to take steps towards new opportunities, and gratifies senior executives and stakeholders.

Essentially, a risk management strategy closely aligned with market realities enables businesses to take risks to succeed, such as through innovating with technology, or determining the costs of avoiding risks altogether. It also contributes to improved business decision making, adding further protection to employees and customer data, and reducing potential damage to brand image and reputation.

“Risk management activities play a vital role in the ongoing resiliency and viability of their organizations.”

Building an Effective Risk Management Strategy

Businesses have to respond quickly and decisively when it comes to risks. They need to think and act digitally. They must adapt and innovate at the speed of the market to transform the customer experience. Quality information and data for decision-making are at a premium and have become table stakes,

Once specific risks are defined, organizations can determine how to best react to them. What strategies have worked well in the past, and which strategies and approaches have failed? By engaging with executives throughout the organization, you can help to better determine the best approaches by evaluating the opinions and experiences of different individuals.

Automation and advanced analytics, such as AI and ML, are becoming key drivers for combating risks in real time rather than traditional, manual approaches.

Using advanced analytics as the core of your risk management processes allows organizations to better detect and identify issues, and proactively address specific business vulnerabilities and scenarios where risk can occur and disrupt the organization.

Part of an organization’s risk strategy also needs to include actions to take during a potential crisis, such as response, planning resource allocation, developing communication strategies, and the role of leadership in taking charge of particular risk scenarios.

It’s possible to start allocating and developing risk associated talent, who are better equipped at understanding risk management practices and driving technological adoption integral to preventing risk, such as risk vulnerability assessment tools in combination with blockchain, robotic process automation (RPA), and analytics.

Whether those risks are macroeconomic, strategic, or operational, businesses need to diversify their approach to defining new business models that bring them competitive advantage. This results in improved business resilience and continuity, such as being able to implement hybrid remote work environments or improve collaboration, or by adapting to digital technologies that alter products and services when encountering changing customers’ behaviors during uncertainty.

Needless to say, integrating risk into company culture helps organizations mature in risk management and makes risk management an everyday part of business best practices. This results in a reinforcement of the value of risk management as a coordinated effort throughout the entire organization, which better prepares everyone for the likelihood of any future risk.

Effectively Respond to Risks Now and in the Future

The current and emerging risk climate demands effective support and responsiveness to various conditions via real-time adaptability, organization-wide inclusion in risk mitigation, and the operational capabilities to generate value-driven, scenario-based approaches towards risk.

By Ronald van Loon

The ‘Cloud Syndicate’ is a mix of short term guest contributors, curated resources and syndication partners covering a variety of interesting technology related topics. Contact us for syndication details on how to connect your technology article or news feed to our syndication network.