5G is clearly a new revolution which supports various new technologies – autonomous cars, augmented and virtual reality – by providing low latency and higher bandwidth on the network. For the first time, with 5G, telecom network workloads are shifted to cloud and becoming the service-based architecture (SBA) where network will be used to push services to subscribers. Additionally, edge clouds are being introduced which further extends 5G capabilities and delivers faster, reliable services by physically putting processing and storage capacity closer to the end user.

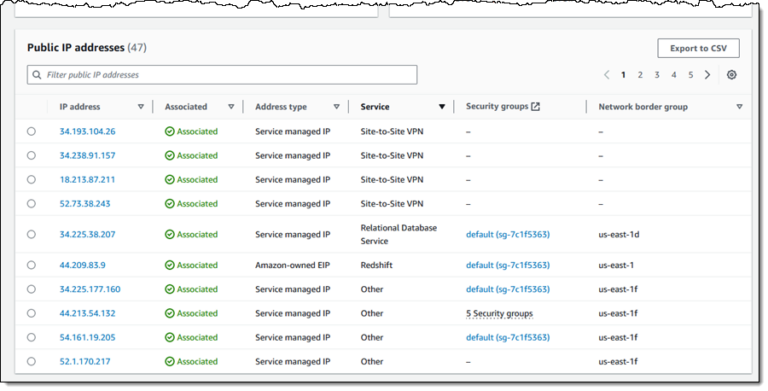

It is seen that telcos and hyperscalers like Amazon Web Services (AWS), Microsoft Azure and Google Cloud are looking to make the most of opportunities which arise with 5G cloud and edge cloud. The concept of cloud-based 5G is completely new for telcos who are experienced in proving the last mile connectivity at every part of the continent or country. Hyperscalers are good at providing the agility, availability and innovation applications and have smooth operations globally. To tap the opportunities in edge, hyperscalers came up with new solutions – Outposts and Wavelength, Azure Edge Zones, Google Anthos – to stay in the hunt to deliver services from cloud to edges.

Additionally, the Open RAN movement, not just the edge, opens the door for telcos and hyperscalers to strategise the revenue model as it will involve more vendors participating in RAN innovation.

Cases where telcos and hyperscalers will work together

Despite having vast experience in managing services and operations of huge networks, due to cloud adoption for 5G, telecom networks cannot explode the network requirements like various upgrades of software component, network equipment and purpose-built hardware resources. Telecom networks need to build and strengthen the cloud-based platform and orchestrate the network function effectively to deliver agility in application deployments. Hyperscalers can help in this case to quickly roll out the infrastructure and platforms to monitor those components and scale or upgrade when needed.

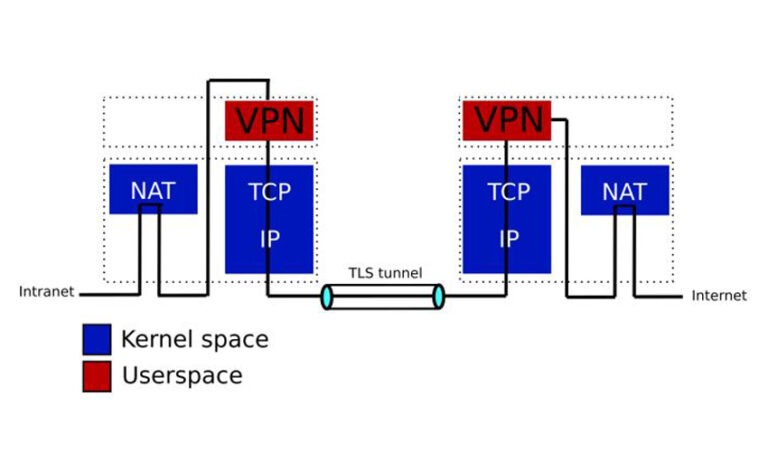

The main reason for having edge cloud closer is for the end user to process and deliver data as swiftly as possible. This process also holds the state of data which is important for applications deployed at the edge. Telcos will need hyperscalers in this case so that it is possible to manage and distribute the data across various edges and towards end users.

It will continue to be time consuming for telcos to push NFV infrastructures which form the edge cloud that will be deployed at various data centre locations and further interconnection will be required to manage and orchestrate from a single pane of glass. Hyperscalers can help in this case to provide services around containers and orchestration platforms like Kubernetes to streamline service operations at NFV infrastructure level. Wavelength Zones and Azure Zones for instance can help in this case. This way hyperscalers get more control on the applications and services part of the network but it resolves the issues of faster deployment along with better control.

Recent innovations in telecom networks are capabilities such as zero touch operations and network-as-a-service which brings more power to extend the key forte of operators to manage vast networks. But with this ‘cloudification’, it is important to take into account the 5G services to be offered to customers and customised services offered through edge cloud. Various vendors are going to be involved in edge cloud to deploy their applications in various regions, such as startups, OTT providers, and established software vendors.

As per a KPMG report (pdf), by 2023, with a growth in the adoption of 5G and edge computing, the five target industries (industrial manufacturing, connected healthcare, intelligent transportation, gaming, and environmental monitoring) are forecast to generate US$500 billion in annual revenue into the entire ecosystem, including connectivity, hardware, software and services.

Considering this, it becomes important for both telcos and hyperscalers to join hands considering the proliferation of edge-based services. This will open up new revenue streams for both.

Furthermore, hyperscalers are powerful in terms of finances and capabilities around software applications (automation, reliability, security). But to stay in the 5G and edge game, hyperscalers lack the penetration in last-mile connectivity, and would like to use the extensive and vast network connectivity strength of telcos. Telcos are evolving to software-based nature at various stages – from cloud to edge and far edge – and hyperscalers will help them provide customers of desirable application with low latency.

Telcos also have the upper hand in terms of buying a spectrum from local governments to deploy their networks and procure the necessary licenses and approval to provide telecom services. By partnering with telcos, hyperscalers can theoretically bypass the need for having those licenses to deliver the cloud services.

Conclusion

Hyperscalers and telcos have their own strengths and weaknesses to deliver high performance 5G. Telcos are now advanced due to network automation and network-as-a-service capabilities, while hyperscalers are strong with data analytics, AI/ML, security and lifecycle management of software components and services. But both have their own limitations for 5G. At the customer end, after a spike in internet usage due to Covid-19 last year it is surely necessary that both should collaborate and evolve further to overcome future challenges in delivering services.

Photo by Paul Green on Unsplash

Want to learn more about topics like this from thought leaders in the space? Find out more about the Edge Computing Expo Europe on June 16-17, a brand new, innovative event and conference exploring the edge computing ecosystem.