In 2023, we saw generative AI usher in a wave of new innovations, from Microsoft Copilot to the “last song” from The Beatles to helping rural India farmers gain easier access to government services. These AI innovations are now starting to show up in our everyday lives and have a positive impact for millions of people around the world.

Last week, as part of Microsoft’s FY24 Q2 Earnings, we announced we now have 53,000 Azure AI customers. Over one-third are new to Azure this calendar year.

And we have great momentum with Azure OpenAI Service, too, which became generally available just over 12 months ago, empowering developers and organizations to build AI applications with OpenAI’s latest models (including GPT-4 Turbo with Vision, fine-tuning for the foundational models, and DALL-E 3) backed by the enterprise capabilities of our Azure cloud. We continue to introduce new innovation with Azure OpenAI Service including Assistants API in preview, text-to-speech capabilities, support for new models, and updates to fine-tuning API.

Azure AI

Build intelligent apps at enterprise scale with the Azure AI portfolio

Today, thousands of organizations around the world are using Azure OpenAI service to drive meaningful business impact for people and society. We are seeing increased usage from AI-first startups like DeepBrain, Perplexity, and SymphonyAI, as well as the world’s biggest companies. Over half of the Fortune 500 use Azure OpenAI today, including AT&T, Walmart, Ally Financial, and Carmax.

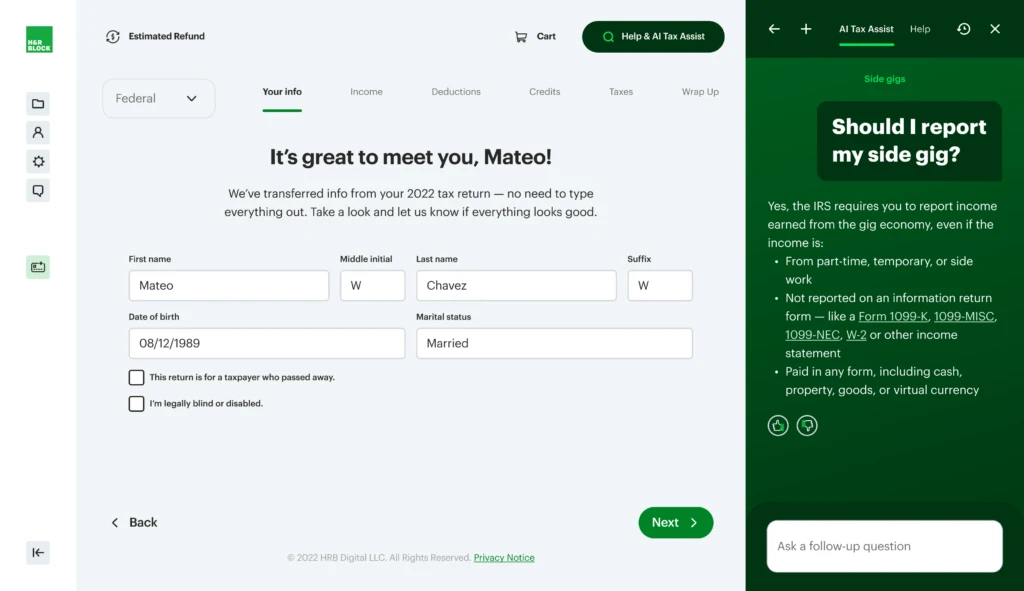

Helping taxpayers with AI Tax Assist

It’s no secret that filing taxes can be stressful, overwhelming, and time-consuming. According to the IRS, the average taxpayer spends 13 hours preparing their return. As we enter this year’s tax season (the IRS officially began accepting eFiling from individuals on January 29), it’s especially exciting to see how H&R Block is leveraging the generative AI capabilities of Azure to help ease the filing process for taxpayers this year.

Almost half (46%) of the 146 million tax filers in the U.S. prepare and file their own taxes. This season, those 69 million DIYers will have the ability to simplify the tax preparation process with H&R Block AI Tax Assist.1

Sound familiar? You may have caught a glimpse of AI Tax Assist commercials last month during the NFL playoffs, or when the solution first launched in December 2023.

H&R Block AI Tax Assist is a generative artificial intelligence (GenAI) experience that harnesses the power of Azure OpenAI Service to help streamline the tax preparation process for individuals, the self-employed and small business owners to file and manage their taxes confidently.

“With H&R Block AI Tax Assist, we are enhancing the DIY tax filing experience. By applying generative AI tools with our unique ability to provide human expertise at scale, we’re taking a step forward in innovation to help make the tax filing process easier. We’re thrilled to work with Microsoft and leverage the power of Azure OpenAI Service to transform how Americans do their taxes.”

– Heather Watts, Senior Vice President of Consumer Tax Products, H&R Block

Leveraging data from H&R Block’s The Tax Institute and the experience of more than 60,000 tax professionals, H&R Block AI Tax Assist helps DIY customers efficiently work through the tax preparation process by assisting with:

- Tax Information: AI Tax Assist can provide information on tax forms, deductions, and credits, maximizing potential refunds and minimizing tax liability.

- Tax Preparation: AI Tax Assist can guide individuals through questions as they prepare and file their taxes, answer tax theory questions and offer navigation instructions when needed.

- Tax Knowledge: AI Tax Assist can answer free-form tax-related questions, providing dynamic responses that clarify tax terms and give guidance on specific tax rules or general information about the U.S. and state tax system.

- Tax Changes: AI Tax Assist can answer questions about the tax code, recently changed laws and tax policies.

“H&R Block has built a long-standing partnership with Microsoft starting with migration to Azure as a part of our broader digital transformation. As we considered platform partners for building the AI Tax Assist and AI Platforms more broadly, we indexed heavily on speed-to-market while ensuring we did it safely, responsibly, and honoring the trust our clients place in our brand every day. The capabilities of Azure OpenAI Service to enable responsible deployment of AI were critical in helping build confidence in this new solution and allowed us to deploy this new technology at scale to our clients early in our journey.”

– Alan Lowden, Chief Information Officer, H&R Block

Driving business impact with Azure AI

Like H&R Block, organizations including AT&T, Inflection AI, PwC, Siemens and Volvo are using Azure AI to reimagine customer experiences, remove friction in business-critical processes to help end-users and employees focus their time and energy on valuable work.

Whether building a copilot, a chatbot, or a creative assistant, businesses are taking advantage of Azure AI’s model choice, flexibility and multimodal capabilities through Azure AI Studio to innovate faster and more responsibly across a range of diverse services including education, financial services, healthcare, manufacturing, and risk management.

Our commitment to responsible AI

With Responsible AI tools in Azure, Microsoft is empowering organizations to build the next generation of AI apps safely and responsibly. Azure AI Content Safety is a state-of-the art AI system that helps organizations keep AI-generated content safe and create better online experiences for everyone. Customers—from startup to enterprise—are applying the capabilities of Azure AI Content Safety to social media, education and employee engagement scenarios to help construct AI systems that operationalize fairness, privacy, security, and other responsible AI principles.