Flexera has released its 2021 State of the Cloud Report, a yearly benchmark in the cloud industry around strategy, workload allocations, cost management, and more.

The study, which polled 750 global decision makers and users around the public, private and multi-cloud market, found enterprises continue to embrace multi-cloud and public cloud – but continued to struggle with the spend.

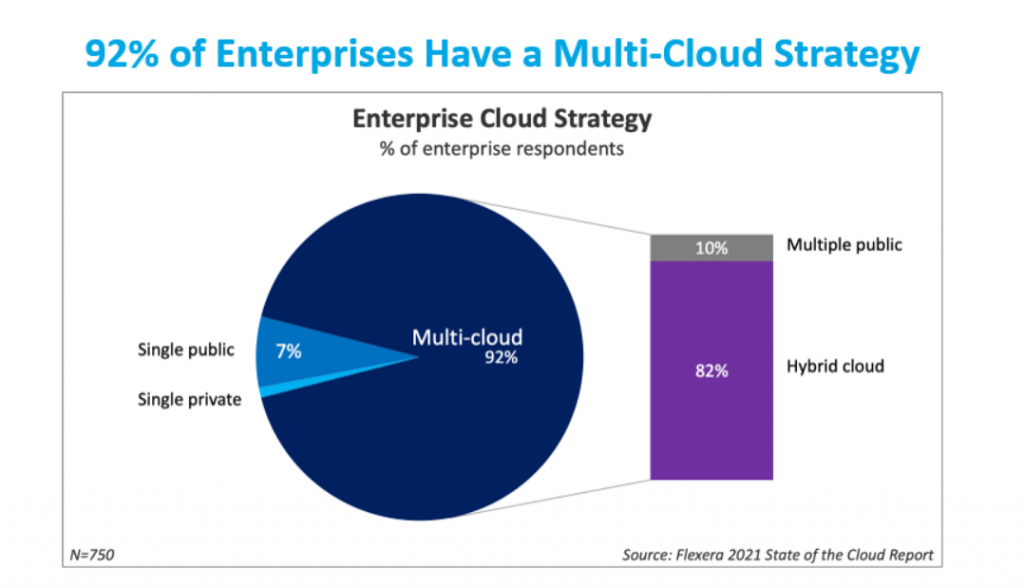

92% of those polled had a multi-cloud strategy. This is slightly down from the 93% in the 2020 edition. However, whereas 87% of last year’s cohort used a hybrid cloud strategy, this number has dropped to 82% this time around – meaning more organisations are using multiple public clouds.

In the same vein, just under a third (31%) of enterprises said they spent more than $12 million a year – seven figures per month, for the less mathematically inclined – on public cloud. This is up from one in five this time last year. It is a lucrative industry, yet there is still much more room for growth. 54% of enterprise workloads are expected to be in the public cloud in 12 months.

The 2020 report, released in April, fell amid the first global lockdowns of the coronavirus pandemic. As a result, Covid’s fledgling impact was top of mind. 12 months later and the trend of accelerated digital transformation is affirmed here; 90% of those polled who answered a question on Covid-19 believed cloud use will exceed plans.

For the fifth year running, the top initiative for organisations was optimising cloud costs – cited by 61% of those polled. More than three quarters (76%) overall said they used cost efficiency and saving to measure cloud progress.

In terms of specific vendors, Amazon Web Services (AWS) continues to be top of the shop with a slight increase in terms of percentage points, but Microsoft Azure closed the gap significantly. AWS has penetration among 77% of Flexera respondents, up from 76%, ahead of Azure on 73% – up from 63%. Google Cloud also saw double-digit growth year-on-year, at 47% from 35% the year before, as did Oracle (29%) and IBM (24%).

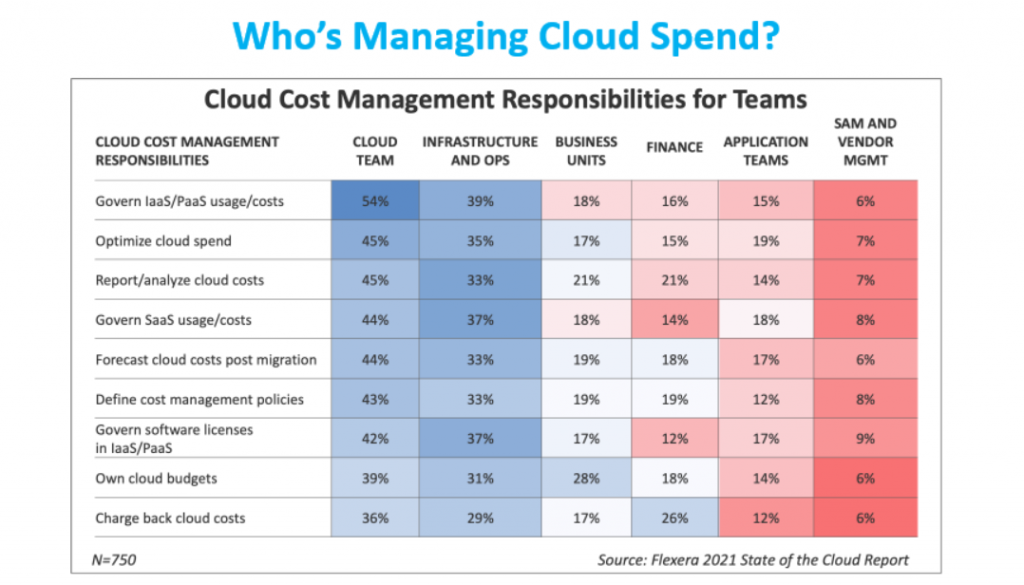

When it comes to organisational approaches to cloud, three quarters of respondents have a central cloud team (39%), or a center of excellence (36%). This is more apparent in enterprises, where only 8% had no plans, compared with SMBs (23%).

This naturally takes away from other departments, already burdened with myriad other duties. For financial segments cloud teams still dominate. Reporting and analysing cloud costs was a task for the cloud teams in almost half (45%) of companies polled, compared with 21% for finance. Charging back cloud costs, with 26% at finance and 36% the specific cloud team, saw less of a disparity.

While managing cloud spend was the top initiative, security remained the top challenge, cited by 81% of respondents compared with 79%. Yet governance, compliance and lack of resources all polled above 75%. For the enterprise side, these challenges remain constant, but slightly more attainable; security fell by two percentage points year on year, with cloud spend at three.

Ultimately, the 2021 iteration of Flexera’s State of the Cloud Report shows yet more continual growth, with no real surprises – Azure’s comparative closing of the gap aside – and Covid accelerating already pernicious problems.

Jim Ryan, president and CEO of Flexera, had a warning, however. “Covid-19 has accelerated the migration to cloud computing. Still, cloud isn’t magic or the land of milk and honey,” he said. “Companies are moving fast, facing challenges, and trying to connect cloud computing to business outcomes.

“Real-world challenges – such as managing security and optimising cloud spend – still must be addressed,” added Ryan.

You can read the full report here (email required) and take a look at the 2020 roundup here.

Main pictures published under an Open Source Creative Commons License

Photo by S O C I A L . C U T on Unsplash

Interested in hearing industry leaders discuss subjects like this and sharing their experiences and use-cases? Attend the Cyber Security & Cloud Expo World Series with upcoming events in Silicon Valley, London and Amsterdam to learn more.